Although the housing and mortgage markets look set to continue to show greater levels of activity in 2014, the Council of Mortgage Lenders, believes that an unbridled housing boom is unlikely.

Although the housing and mortgage markets look set to continue to show greater levels of activity in 2014, the Council of Mortgage Lenders, believes that an unbridled housing boom is unlikely.

In fact, given the already stretched nature of household finances, the new regulatory environment and the likely future course of interest rates, housing market activity may well ease back of its own accord.

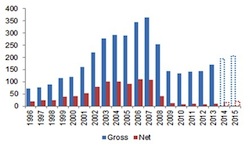

The CML is forecasting a rise in gross lending from an estimated £170 billion this year to £195 billion next year, and £206 billion in 2015. The CML anticipates that net advances are likely to rise from £10 billion this year to £15 billion next year and £20 billion in 2015.

The number of mortgages 2.5 per cent or more in arrears is likely to stay stable next year at around 150,000, but rise modestly to 160,000 in 2015. The number of repossessions is expected to fall from around 30,000 this year to 28,000 next year before returning to 30,000 in 2015.

In terms of specific features currently influencing the mortgage market, the CML suggests that the volumes of business written under the new Help to Buy mortgage guarantee scheme may be relatively modest, "such that it has a smaller but more positive market impact than many commentators suggest".

The CML's forecasting horizon covers a period when the Bank of England may consider increasing interest rates. While this is likely to have a greater impact from 2016, the benign period of falling arrears and possessions may be coming to an end - although most households will cope with the transition to more normal interest rates.

CML chief economist Bob Pannell said: "Gross mortgage lending climbs above £190 billion next year, its highest level since 2008. While this is largely on the back of the continuing revival in housing market activity, we also expect to see a meaningful turn-round in remortgage activity.

"Despite a strong pick-up in gross mortgage lending, we have pencilled in relatively modest net lending figures - £15 billion in 2014 and £20 billion in 2015. While this would mark a climb out of the sub-£10 billion doldrums, where the market has languished since the credit crunch, it does nevertheless represent a rather muted position. This reflects, among other things, our view that some households will use the relatively benign economic conditions to prioritise debt repayments, ahead of medium-term interest rate rises.

"We think there are good grounds to be optimistic that the vast majority of households will cope with a slow but certain transition to more normal interest rates. This seems to be the game-plan which the Bank of England has in mind, but presumes (as we do) that the UK avoids a destabilising housing boom over the next few years."

9 Jan 2017

9 Jan 2017 8 Dec 2016

8 Dec 2016 29 Apr 2015

29 Apr 2015 12 Mar 2015

12 Mar 2015 12 Mar 2015

12 Mar 2015Have you any commercial property events you'd like to tell us about? It could be networking, exhibitions, seminars, industry lunches or sporting fixtures. We will list them for free. Just email newsdesk@propnews.co.uk with the following details: Event name, date, time, venue, cost, booking info and a brief description of the event.

To list your property job vacancies on Property News. Email: richenda@propnews.co.uk.