Farmland has out-performed both equities and commodities in terms of value growth and levels of volatility over the past 17 years, with momentum continuing into the first quarter of 2013, according to Chesterton Humberts' latest rural research report.

Since 1995, average farmland values have risen by 9.2 per cent per annum, well above equities (4.1 per cent) and gilts (7.4 per cent), whilst returns were much less volatile (12.4 per cent) when compared to oil (51 per cent) and gold (14.7 per cent). This makes it one of the best performing asset class in terms of low risk and high returns after gold.

Chesterton Humberts has recently set up an index to monitor growth in agricultural estate values. According to the company's Chesterton Humberts' new Agricultural Estates Index, which tracks quarterly changes in the value of a standard basket of agricultural estate types (from bare land parcels up to fully equipped residential estates) with Grade 1, 2 & 3 land only,* average estate values rose by 0.4 per cent in Q1 2013 to stand at £10,581 per acre.

The biggest uplift was seen in the larger transactions, which are mainly driven by investors seeking opportunities to achieve worthwhile economies of scale. Overall however, farmers remain the main buyer group as they seek to expand their existing acreage, followed by UK investors and private purchasers, including overseas buyers taking advantage of the current weakness of sterling.

Andrew Pearce, head of Chesterton Humberts' rural agency, said: "Despite the weather failing to improve during the first quarter of 2013, there is certainly a compelling long term case for investing in farmland. The main advantages, which include scarcity value, rising food demand and tax advantages, are set to continue for the foreseeable future. Additionally, the changing global weather patterns are likely to exert upwards pressure on food commodity prices, whilst technology will create longer term cost savings and efficiencies."

Nick Barnes, head of Research said: "The combination of low volatility plus its potential to generate long term capital growth and income allied to potential tax benefits has demonstrated that agricultural estates outperform other assets, including equities and commodities and thus have attracted a wide range of prospective purchasers. Provided the regulatory and tax environment stays relatively benign, it is likely to be only a matter of time before the institutional funds become more involved in the sector again."

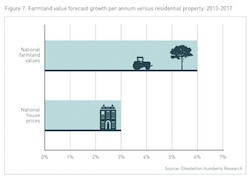

Chesterton Humberts is now forecasting that agricultural estate values will grow at a rate of 5 per cent p.a over the next five years due to a combination of the longer term positive fundamentals of the sector and the supply/demand imbalance. This figure may well be exceeded in some local markets where the availability of larger estates will drive growth in values.

9 Jan 2017

9 Jan 2017 8 Dec 2016

8 Dec 2016 29 Apr 2015

29 Apr 2015 12 Mar 2015

12 Mar 2015 12 Mar 2015

12 Mar 2015Have you any commercial property events you'd like to tell us about? It could be networking, exhibitions, seminars, industry lunches or sporting fixtures. We will list them for free. Just email newsdesk@propnews.co.uk with the following details: Event name, date, time, venue, cost, booking info and a brief description of the event.

To list your property job vacancies on Property News. Email: richenda@propnews.co.uk.